.

Many companies either rent or lease things like buildings or vehicles to other companies, or they rent things from other companies. When it comes to tracking and reporting the emissions produced by these rented or leased assets, it can be a bit complex.

Here’s what you need to consider:

- Type of Emissions: The first thing to figure out is what kind of emissions are being generated by these leased assets. Are they directly related to your company’s operations, or are they more indirect, such as emissions from the production of the leased assets?

- Organizational Boundary: This means understanding how your company is connected to the companies you’re leasing from or leasing to. Are you closely tied in terms of ownership (equity share), financial control, or do you have control over how these assets are operated?

- Type of Lease: The kind of lease you have matters too. Is it a financial lease where you practically own the asset, or is it an operating lease where you’re just using it for a certain period?

Based on these factors, you’ll determine where in your emissions reporting these leased assets fit. Are they part of your core operations (scope 1 or scope 2 emissions) or are they more on the periphery, like the emissions generated by companies you’re connected to (scope 3 emissions)? It all depends on the specifics of your situation.

Differentiating types of leased assets

Finance or Capital Lease:

Think of a finance or capital lease as a type of lease that’s almost like owning the asset. When a company has a finance or capital lease, it means they get to use the asset, like a building or vehicle, and they also take on all the risks and rewards of owning it.

These kinds of leases are treated as if the company outright owns the asset in their financial records. So, on their balance sheet (a financial document that shows a company’s financial position), the leased asset is counted as if it’s owned entirely by the company.

Operating Lease:

An operating lease is different. In this type of lease, the company gets to use the asset, but they don’t take on the risks or rewards of owning it. It’s like renting a house rather than buying it. You get to live in it, but you don’t own it, and you don’t have to deal with all the costs and responsibilities of ownership.

If a lease doesn’t fall into the finance or capital lease category, it’s considered an operating lease.

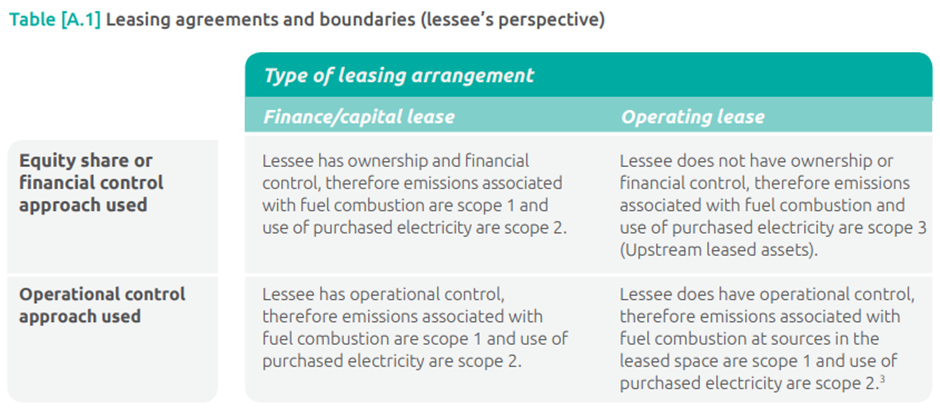

Now, when it comes to emissions, the next step is to figure out how these emissions are categorized by the company that’s doing the reporting. Companies need to be clear about whether the emissions from these leased assets should be counted as scope 1, scope 2, or scope 3 emissions.

The key here is to make sure that the emissions aren’t counted twice. If the lessee counts emissions as scope 2, the lessor should categorize the same emissions as scope 3, or vice versa. This ensures that emissions in scopes 1 and 2 aren’t double-counted, which would give an inaccurate picture of the company’s environmental impact.

Lessee’s perspective: Categorizing emissions from leased assets

Imagine a company that needs a place to run its business, like an office or a store. Instead of buying a place, they rent it from another company, like a real estate company.

Now, when it comes to counting the emissions related to this rented space, it can be a bit like a puzzle, and it depends on two things:

Organizational Boundary Approach:

This means how closely the renting company (lessee) is connected to the real estate company (lessor) in terms of ownership, control, or operations.

- If it’s like owning it (scope 1): If the renting company is very closely connected to the real estate company, meaning they have a lot of control over the space and how it’s used, they might count the emissions as part of their core operations (scope 1). It’s like saying, “This is directly related to what we do.

- “If it’s indirect but important (scope 2): If the connection is more like, “We need the space, but we don’t own it or have full control,” they might categorize the emissions as part of their indirect operations (scope 2). It’s a bit like saying, “It’s not our property, but it’s really important for our work.”

- If it’s pretty separate (scope 3): If the connection is looser, and the real estate company manages everything about the space, the emissions might be considered as more on the outside of the company’s operations (scope 3). This is like saying, “We’re using it, but it’s not really our responsibility.”

Type of Leasing Arrangement:

This means the specific terms of the lease. Is it a situation where the renting company basically owns the space during the lease (like a finance lease), or is it more like renting a place for a while (an operating lease)?

- Ownership-like (scope 1): If it’s like the renting company owns the space for the duration of the lease, they might consider the emissions as part of their own operations (scope 1). It’s similar to saying, “While we’re renting it, it’s basically ours.

- “Renting without owning (scope 2): If the lease is more like renting without the responsibility of ownership, they might categorize the emissions as an indirect part of their operations (scope 2). It’s akin to saying, “We use it, but it’s not really ours.”

.

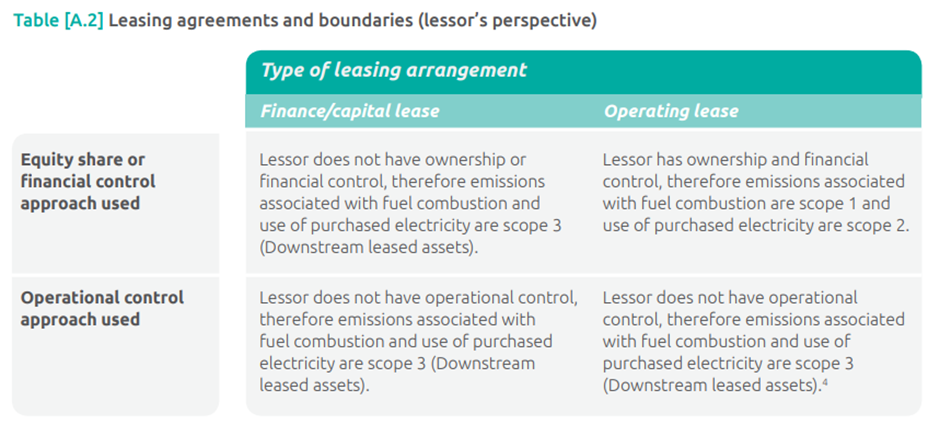

Lessor’s perspective: Categorizing emissions from leased assets

Imagine there are some companies that own things, like buildings or a fleet of vehicles, and they let other companies use these things in exchange for money.

Now, when it comes to counting the emissions related to these things that they’re renting out, it depends on two things:

Organizational Boundary Approach:

This means how closely the company that owns these things (the lessor) is connected to the company that’s renting them (the lessee) in terms of ownership, control, or operations.

- If it’s like the thing is really theirs (scope 1): If the lessor is very connected to the lessee and has a lot of control over how the rented things are used, they might count the emissions as part of their core operations (scope 1). It’s like saying, “This is directly related to what we do.”

- If it’s more like, ‘They’re using it, not us’ (scope 2): If the connection is more like, “We own the stuff, but it’s not directly connected to our business,” they might categorize the emissions as part of their indirect operations (scope 2). It’s a bit like saying, “We own it, but it’s not our main thing.”

- If it’s pretty separate (scope 3): If the connection is looser, and the lessee manages everything about the rented things, the emissions might be considered as more on the outside of the lessor’s operations (scope 3). This is like saying, “We own it, but it’s not really our responsibility.”

Type of Leasing Arrangement:

This means the specific terms of the lease. Is it a situation where the lessee basically owns the rented things during the lease (like a finance lease), or is it more like renting things for a while (an operating lease)?

- Ownership-like (scope 1): If it’s like the lessee owns the things for the duration of the lease, the lessor might consider the emissions as part of their own operations (scope 1). It’s similar to saying, “While they’re renting it, it’s basically ours.”

- If it’s pretty separate (scope 3): If the connection is looser, and the lessee manages everything about the rented things, the emissions might be considered as more on the outside of the lessor’s operations (scope 3). This is like saying, “We own it, but it’s not really our responsibility.”