Assurance is the level of confidence that the inventory is complete, accurate, consistent, transparent, relevant, and without material misstatements. While assurance is not a requirement of this standard, obtaining assurance over the scope 3 inventory is valuable for reporting companies and other stakeholders when making decisions using the inventory results.

.

Benefits of assurance

- Increased Confidence for Senior Management: When we ensure that the data related to a company’s environmental impact (like carbon emissions) is accurate, senior managers can trust this information. They can then use this reliable data to set goals and make decisions about how to reduce the company’s impact on the environment.

- Better Internal Processes: Assuring scope 3 inventory results also means improving how a company collects and manages data. This can lead to better practices for gathering information, calculating environmental impacts, and reporting internally. It’s like making sure all the gears in a machine work smoothly, which helps everyone understand what’s happening and how to improve.

- Efficiency in Updating Inventory: When a company keeps its environmental data accurate, updating it in the future becomes easier. It’s like keeping your room tidy regularly so that you don’t have to spend a lot of time cleaning up a huge mess later.

- Stakeholder Confidence: Stakeholders are people and groups interested in the company’s environmental impact, such as investors or the public. When they see that a company’s environmental information is reliable, they have more confidence in the company’s efforts to reduce its impact.

To prepare for assurance, it’s important to carefully and thoroughly document how the company handles its environmental data. This documentation is called a “data management plan,” and it’s a crucial step to make sure that all the information is handled correctly and can be trusted. It’s like having a clear set of instructions on how to do a task so that you can be sure it’s done right.

.

Relationships of parties in the assurance process

Three key parties involved in the assurance process:

- The Reporting Company: This is the company that’s sharing information about its environmental impact, like greenhouse gas emissions. They are the ones who want to make sure that this information is accurate and reliable.

- Stakeholders: These are people or groups who use the information provided by the reporting company. They might be investors, customers, or the public. They want to know that the information is trustworthy because they make decisions based on it.

- The Assurer(s): These are the individuals or organizations responsible for checking and confirming that the information shared by the reporting company is accurate. They are like fact-checkers, ensuring the numbers are correct.

.

Types of assurance:

- First Party Assurance: This is when the reporting company itself checks its own data. It’s like a student grading their own test. It can provide some confidence in the data, but it’s not as objective as having someone else check it.

- Third Party Assurance: This is when an independent party, not connected to the reporting company, checks the data. It’s like having a teacher grade the student’s test. This is more objective and tends to be more trustworthy for external stakeholders (like investors or the public).

It’s important for companies to choose assurers (the checkers) who are independent and not biased in favour of the company. They should be completely neutral and have no conflicts of interest with the company’s environmental data.

Both first and third party assurance should follow similar procedures to make sure the data is accurate. Third party assurance, however, is often seen as more credible because it’s done by an independent party. But, first party assurance can still be useful for a company to learn how to improve its data before seeking third-party confirmation.

Threats to independence, like financial conflicts of interest, should be carefully looked into during the assurance process. If a company gets first party assurance, they should also explain how they avoided conflicts of interest during the checking process.

.

Competencies of assurers

Why Selecting a Competent Assurer Matters:

Choosing the right person or organization to check the accuracy of a company’s environmental data is crucial. This is because the findings of this assurance process need to be trusted by both the company and the people who use that data, like investors and the public.

Characteristics of a Competent Scope 3 GHG Inventory Assurer:

- Assurance Expertise and Experience: The assurer should have experience in this kind of work. It’s like hiring a skilled mechanic to fix your car rather than someone who has never worked on cars before. They should know how to use the tools and methods for checking data.

- Knowledge of Environmental Accounting: The assurer should understand how companies calculate and report their environmental impact, like greenhouse gas emissions. They should be familiar with the steps involved in collecting and reporting this data.

- Industry Knowledge: It’s helpful if the assurer knows the kind of business the company is in. For example, if the company is a tech company, the assurer should be aware of the technology industry. This knowledge helps them understand the specific environmental challenges that company might face.

- Ability to Spot Mistakes: The assurer should be good at finding errors, omissions, and misrepresentations in the data. Think of them as a detective looking for clues to make sure everything adds up correctly.

- Credibility and Independence: The assurer should be trustworthy and not have any conflicts of interest with the company. They should be completely neutral and unbiased. Imagine them as a referee in a sports game – they need to be fair to both teams.

- Professional Scepticism: This means they should not just accept everything they see at face value. They should ask tough questions and double-check the data. It’s a bit like being a detective again, making sure everything is as it should be.

Assurance process

Common Elements in Assurance Engagements:

- Planning and Scoping: This is about figuring out what needs to be checked, like the risks and mistakes that could happen.

- Identifying Emission Sources: It means finding and listing all the things that contribute to a company’s environmental impact.

- Performing the Assurance Process: This is the actual work of gathering evidence, doing calculations, and other tasks to make sure the information is correct.

- Evaluating Results: After doing all the checks, the results are reviewed to see if everything looks right.

- Determining and Reporting Conclusions: This is where they decide and tell others if the information is trustworthy or if there are issues.

Levels of Assurance: Limited and Reasonable Assurance

- Limited Assurance: This means being somewhat confident in the information but not completely sure. It’s like being 80% sure something is right. The checks here may not be as thorough as for reasonable assurance.

- Reasonable Assurance: This is a higher level of confidence. It’s like being 95% sure something is right. Checks are more detailed and rigorous, and this is what most people prefer when they want to trust the information.

Timing of the Assurance Process:

The assurance process happens before the company shares its report with the public. This allows any mistakes or problems to be fixed before the report goes out. It’s like editing a document before publishing it. The timing depends on how complicated the data is and how much assurance is needed.

.

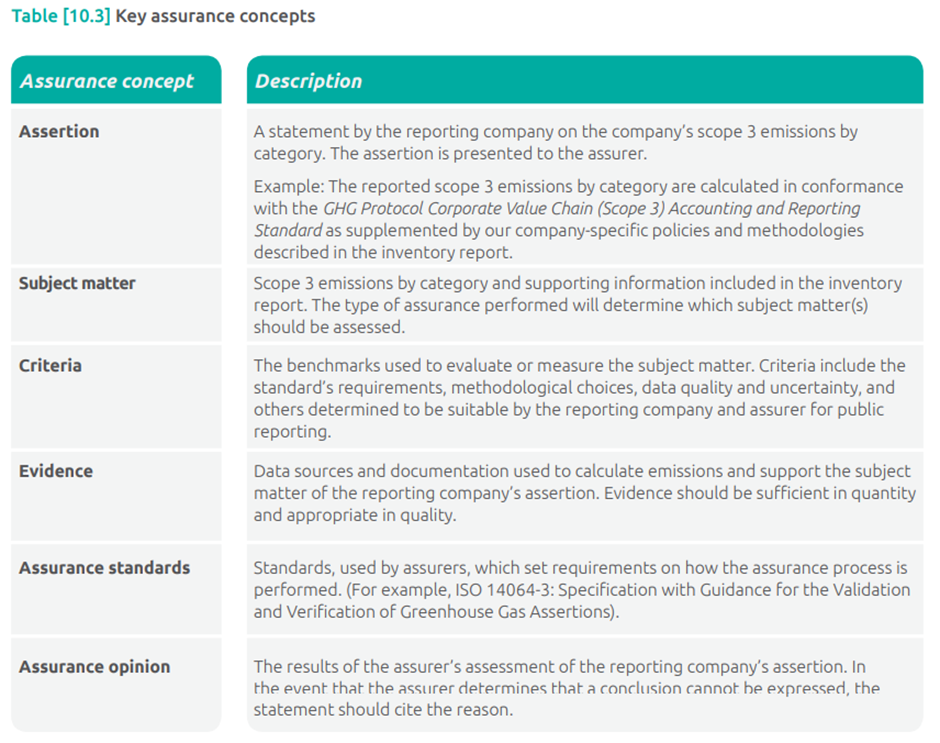

Key concepts in assurance

In the field of assurance, there are different words and phrases used to describe various processes. Some of these terms include verification, validation, quality assurance, quality control, and audit. These are all methods or processes to ensure that information is accurate and reliable.

Materiality:

Materiality is a really important concept in assurance. It’s about figuring out when mistakes or problems in the information are significant enough to matter. In other words, it helps us decide when an error is big enough to affect the decisions of the people using the information.

- Quantitative Materiality: This is about looking at the numbers. For example, if you find a mistake, you might ask, “Does this mistake make up a big percentage of the total information?” If it’s a large part, it’s quantitatively material.

- Qualitative Materiality: This is more about the quality or nature of the mistake. Sometimes, even if a mistake doesn’t make up a large part of the data, it could still be important because it might affect the company’s future or mislead people.

So, materiality helps the assurer (the person or organization checking the information) and the reporting company (the one sharing the information) decide when an error is big enough to be concerned about. It’s a bit like deciding if a dent in your car is a small scratch (not a big deal) or a major dent (a big problem) based on both the size of the dent (quantitative) and how it affects the car’s performance (qualitative).

.

Preparing for assurance

Preparing for assurance means getting ready for the process of having someone check and confirm that the information you’re going to share is accurate and trustworthy. This is important because it helps everyone have confidence in the information you’re providing.

Types of Evidence and Documentation:

What you need to prepare depends on what kind of information you’re sharing, what industry your business is in, and what kind of assurance you’re seeking. It’s a bit like getting different tools ready for different jobs – a carpenter uses different tools than a chef.

Maintaining Documentation:

To make sure that the evidence needed for assurance is available, it’s a good idea to keep records of how you’ve collected and managed your data. This documentation is like a recipe book for your data – it shows how you’ve prepared and handled it. It’s also handy to have if someone needs to check your work.

What to Have Ready for the Assurer:

Before the assurance process begins, you should make sure that the following things are ready for the person who’s going to check your information:

- Written Assertion: This is a statement from your company that lays out the results or findings you want to share. It’s like a formal way of saying, “Here’s what we found.”

- Data Management Plan: This is a document (like a guide) that explains how you collected, organized, and handled your data. It’s like showing someone the recipe you used to make a dish, so they can see how you did it.

- Access to Evidence: You should provide access to all the proof and documents that support the information you’re sharing. For example, if you’re reporting on sales, you’d give them access to invoices and sales records. It’s like showing the ingredients you used in your recipe to prove you made it correctly.

.

Assurance challenges

Challenges in Assuring Scope 3 Inventories:

- Data and Assumptions: Calculating emissions for scope 3 inventories involves using various sources of data and making assumptions. This can make the process less certain because it’s based on a mix of information and educated guesses.

- Uncertainty: There is often uncertainty in inventory data, especially when considering different scenarios, like how products will be used and disposed of in the future. This uncertainty can affect the quality of the inventory, making it less reliable.

- Data Collection and Integrity: The quality of the data and the methods used to gather and process it are crucial. If the data isn’t accurate or if there are problems with the methods, it can impact the reliability of the inventory.

- Emission Sources Outside Control: Many of the emission sources in scope 3 inventories are beyond the control of the reporting company. This means the company can’t provide direct evidence or proof of these emissions, making it challenging for the assurer to verify them.

Ways to Address Diminished Control:

When the emission sources are outside the reporting company’s control, there are two main approaches to deal with this issue:

- Change the Level of Assurance: In some cases, it might be necessary to acknowledge that achieving a high level of assurance (like being 100% sure) is not possible due to factors beyond the company’s control. In such situations, the level of assurance might be adjusted to reflect the limitations.

- Rely on Another Assurer: Sometimes, when it’s difficult to directly verify emissions from sources outside the company’s control, another assurer who specializes in those specific areas can provide assurance. For example, if a company relies on suppliers for products or materials, an assurance firm specializing in supply chains might provide assurance for those emissions.

.

Assurance statement

An assurance statement is a formal document that conveys the conclusion or findings of the person or organization (the “assurer”) who has checked and verified the information in a report. It’s like a report card, but for data accuracy and trustworthiness.

Components of an Assurance Statement:

- Introduction:

- It should begin by describing the company that’s sharing the information.

- Mention the assertion made by the company in their report. The assertion is basically what the company claims about the information they’re sharing.

- Description of Assurance Process:

- Explain the qualifications and skills of the assurer (the person or organization that did the checking).

- Provide a summary of the steps taken during the assurance process, what work was done.

- Clarify what the responsibilities were for both the reporting company and the assurer.

- List the criteria (the standards or rules) that were used for checking the data.

- Mention whether the assurance was done by the company itself (first party) or an independent party (third party).

- Specify the standard used to perform the assurance. Think of this as the rulebook used for the inspection.

- Explain how any conflicts of interest (like situations where the assurer could benefit from the outcome) were avoided, especially in first party assurance.

- Conclusion Paragraph:

- State the level of confidence achieved (whether it’s limited or reasonable). This is like saying how sure they are about the information.

- If there’s a materiality threshold (a point at which errors become significant), mention that threshold if it was set.

- Provide any additional details about the conclusion, such as any issues or exceptions discovered during the checking process.

Dealing with Departures:

When the company’s assertion (what they claim) doesn’t match the criteria used for checking, it’s called a “material departure.” If this happens, the company should explain what the impact of these departures is. It’s like saying, “We said we’d do this, but we actually did something else, and here’s what that means.”

Recommendations:

Companies can also include any suggestions made by the assurer on how to improve their data in the future. It’s like getting advice on how to do better in the next report.